- Jun 2, 2025

How to Raise Private Finance for Property Deals in the UK (Without Ads or Begging)

- Adam Slee

- Property investing, Social media

You don’t need thousands of followers, a slick investor pack, or paid ads.

You need a funnel that builds trust and positions you as someone worth investing in.

Why You’re Not Raising Private Finance Yet (Even If You Have a Great Deal)

You’ve posted on social.

You’ve hinted that you're “looking to work with investors.”

You might have even created a basic investor PDF.

But still — no conversations, no leads, no capital.

Here’s why: You don’t have a real investor funnel.

What a Private Investor Funnel Actually Is (And Isn’t)

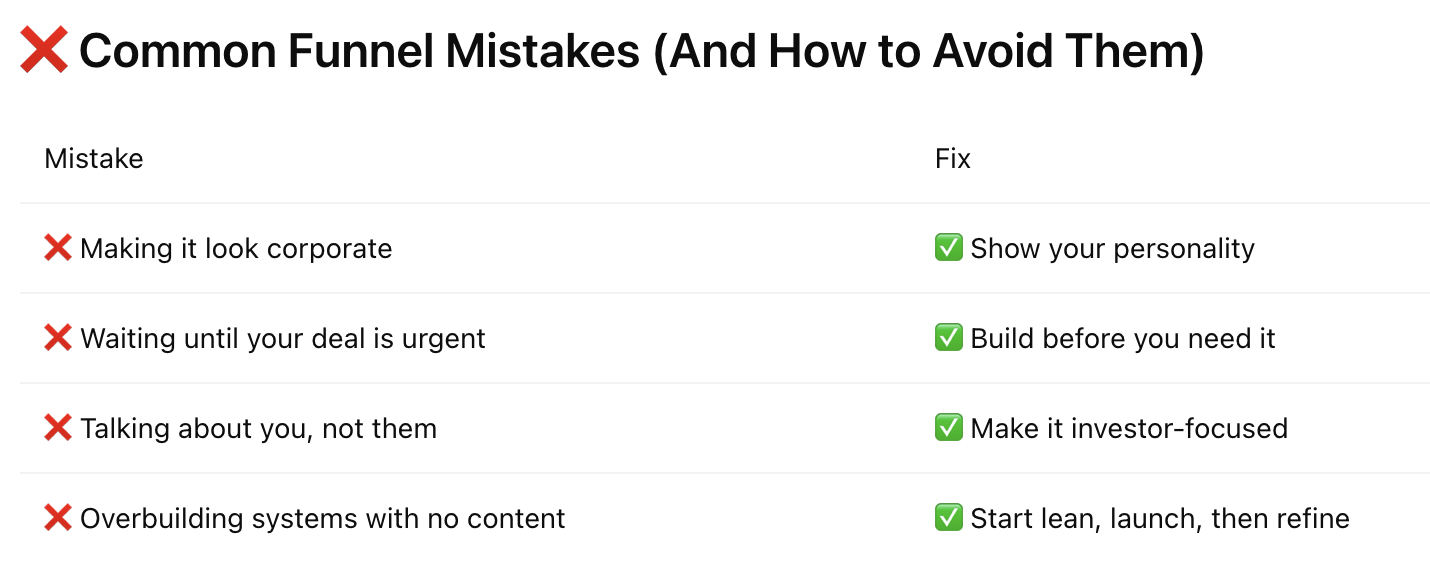

A real investor funnel isn’t a landing page. It’s not a CRM. It’s not a newsletter.

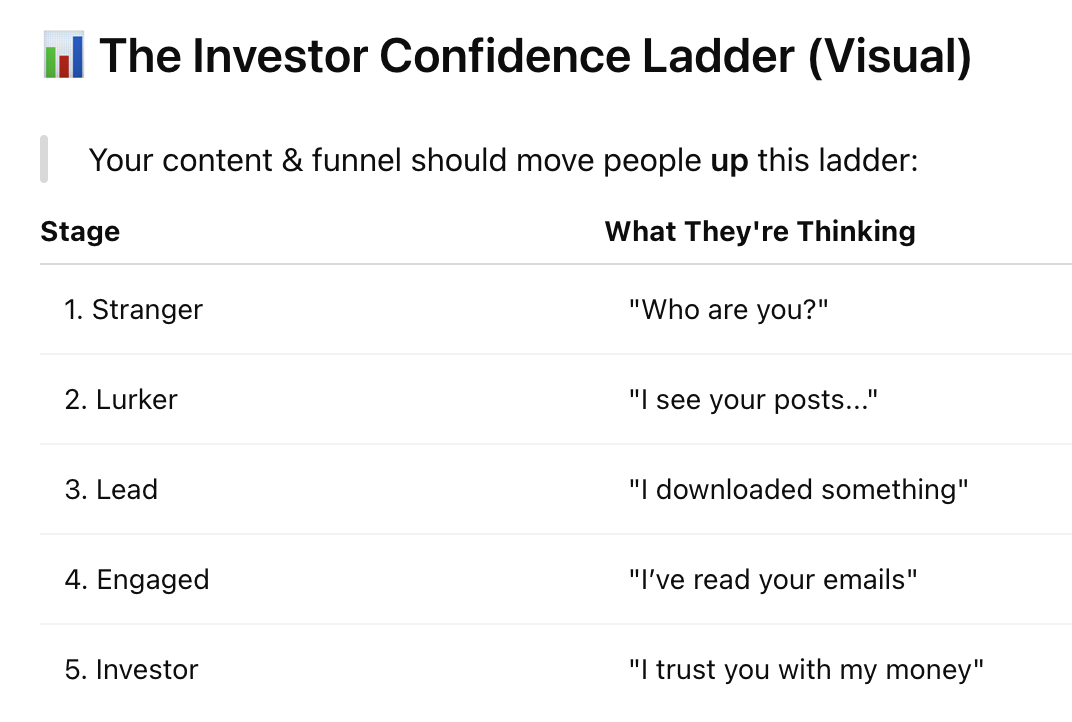

It’s a trust-building system that takes someone from:

Stranger → Lurker → Lead → Confident Investor

And it only needs 3 parts:

Content – to make people curious

Lead Magnet – to filter who’s serious

Follow-Up – to turn quiet interest into private finance

Let’s break that down.

Step 1: Content That Signals You’re Investable

You don’t need to be loud. But you do need to show up consistently and credibly.

✅ The goal of your content:

Show that you know what you’re doing

Be relatable, not salesy

Get people thinking: “Hmm... I wonder if I could work with them.”

🔁 Share deal walkthroughs, your strategy, funding lessons, challenges you’ve faced — all from a value-first angle.

🎓 Inside Property Success Club, we give you post templates, caption starters, and a full Social Media Masterclass if you're stuck.

Step 2: A Lead Magnet That Filters Action-Takers

Once someone’s curious, give them something valuable — and trackable — to move the conversation forward.

✅ Good lead magnet examples:

“My 5-Step System for Attracting Investor Finance in 30 Days” (PDF)

“How I Raised £100k for Property Without a Big Audience” (video guide)

“Investor Pack Template” (editable download)

This filters who’s just watching vs. who’s ready to take a step.

💡 Use MailerLite, ConvertKit, or Podia to deliver it and tag leads for follow-up.

Step 3: Follow-Up That Builds Trust (Not Hype)

Most people send one download and disappear. Don’t.

You only need a simple 3-email sequence:

Email 1: “Here’s your download + my story”

Email 2: “What makes people invest with me” (share your criteria, ethics, risk filters)

Email 3: “Want to talk?” (low-pressure CTA)

🤎 Optional: DM people who downloaded with a personal message like:

“Hey! Saw you grabbed the investor funnel guide — would love to hear what you thought.”

Advanced Tip: Build Trust Before the Ask

Before you ask for money, give value. Here’s how:

Answer DMs with genuine advice

Share deal breakdowns — even ones that went wrong

Record 1-minute videos explaining your process

Show your checklist, your risks, your thinking

The more you share how you think, the more investors believe:

“If they treat their investors like this publicly, I’d feel safe with them privately.”

⛖️ How to Stay FCA-Compliant When Raising Private Finance in the UK

If you’re talking about money, deals, or returns in your content or investor conversations — read this carefully.

The Financial Conduct Authority (FCA) regulates financial promotions — any communication that invites or induces someone to invest.

That includes posts, DMs, emails, PDFs, and videos if they promote a deal.

🔍 What Counts as a Financial Promotion?

Offering a return, equity, or profit on a deal

Asking someone to fund a JV or loan

Promoting deal packs with projected ROI

❌ What You Can’t Do Publicly

Promise returns or interest rates

Publicly ask for money

Pitch a deal unless the person is qualified

✅ Who Can See Investment Promotions?

High Net Worth Individuals (HNWI)

Sophisticated Investors (e.g. previous investors, directors, etc.)

FCA-regulated professionals

💪 How to Stay Legal

Focus on education-first marketing

Use DMs or 1:1 calls for deal conversations

Get investor self-certification before discussing terms

Avoid terms like “guaranteed returns” or “passive income”

🔗 Inside Property Success Club, we include example forms, templates, and compliant workflows.

🔓 Ready to Build Yours?

You could spend 30+ hours building a funnel from scratch...

Or you could swipe mine.

Inside Property Success Club, you get instant access to:

✅ Lead magnet templates

✅ Follow-up email scripts

✅ Investor DM prompts

✅ Funnel walkthrough video

✅ Social content templates

🌟 Join today for just £5.99/month

🚀 Build your investor funnel in 48 hours or less — even with under 200 followers.

❓ Frequently Asked Questions

Do I need a big audience to raise private finance?

No. In fact, many PSC members get investor leads from 100–300 followers using the right system.

Can I use this for lease options or creative deals?

Yes — the funnel helps you build trust and set up conversations, no matter the strategy.

Do I need email automation to do this?

It helps, but you can start with just a Google Drive link and simple email follow-up.

- Free email delivery

The £5k Property Plan

- Download

2 comments

Hi

I read, what you cant do Publicly,

Promise returns or interest rates

Publicly ask for money

Pitch a deal unless the person is qualified

Does this include a post that may discuss, the potential returns investing in property over holding your money in the bank. Can you say things like potential yields of 13% or potential of earning 8% on your investor loan.

Roce returns of 25-35%.

Also can you post looking for investors.

Are These examples a no no for social media period?

Hi,

Great question!

Its best if you just give the top level numbers and leave the outcome to the readers.

Example you can state the purchase price and refurb and then how much its worth when done up. Even how much it will rent for.

No need to put a % or ROCE number.

You can also put how much you purchased it for and how much discount it is.

But stay away from doing anything that looks like you talking about returns (Yield, ROI, ROCE etc).

I also wouldn't talk about returns vs bank either as that also looks like you are offering / selling investment products which you can't do legally.

Keep the numbers top line and there is no problem. Just keep away from anything with a % or looks even remotely like a return.