- Aug 23, 2025

Start UK Property in 2025 (Even with Little or No Money)

- Adam Slee

- Property investing

If you’ve been waiting for the “all clear” from the news… it’s not coming. Headlines change, cycles turn, and the perfect moment never arrives. Meanwhile, real investors are quietly picking up deals and building PASSIVE INCOME, SECURITY, and long-term RETURNS.

This guide gives you a clear 30-day plan, low-capital strategies that actually work in the UK, a case study you can model, and the risk controls to protect your downside.

TL;DR (Read This If You’re Busy)

You can start with Rent-to-Rent, Deal Packaging, Lease Options, or BRR via partners.

Follow the 30-Day Action Plan below to go from “learning” to making offers.

Protect yourself from principal loss, scams, and liquidity traps with the checklists included.

Want the full system (scripts, calculators, masterclasses, community)? Join Property.School for <50p/day — cancel anytime.

Join Property.School — UK Property Training for <50p/day

Weekly live classes, 100+ hours of courses, calculators, scripts, and a private community.

Cancel anytime • UK-focused • Proven frameworks

How to Start in UK Property with Little or No Money (2025 Guide)

Week 1 — Pick Your Strategy & Area (Speed over perfection)

Choose one starter route: Rent-to-Rent, Deal Packaging, Lease Options, or BRR with investor capital.

Shortlist 3 Goldmine Areas: use Rightmove/Zoopla signals (price drops, days on market), rental demand (views/saves), and walkability to key amenities.

Define your buy box: price band, refurb budget, target rent, minimum ROCE.

Week 2 — Build Daily Deal Flow (Pipeline is everything)

Create alerts: price reductions, long DOM, motivated keywords (e.g., “probate”, “vacant”, “chain-free”).

Call 10 agents + 10 landlords (OpenRent/Gumtree) with this opener:

“We specialise in quick, clean solutions (guaranteed rent / fast purchase). Got anything sticking?”Log every lead (Notion/Sheet). Follow up twice weekly.

Week 3 — Validate the Numbers (No guesswork)

Total Investment = Purchase + Refurb + SDLT + Legals/fees.

Monthly Cashflow = Rent – (interest-only mortgage + all running costs).

ROCE = (Annual Net Income ÷ Initial Cash Left In) × 100.

Shortlist 3–5 deals that still work when stress-tested (rates +5%, rents −10%).

Week 4 — Offers + Paperwork (Create options)

View, photograph, and evidence defects to justify your discount.

-

Present two offers:

Price-for-speed (lower price; exchange/completion deadlines)

Price-for-certainty/terms (stronger price with creative terms/lease)

Line up solicitor, broker, and (if needed) JV heads-of-terms before acceptance.

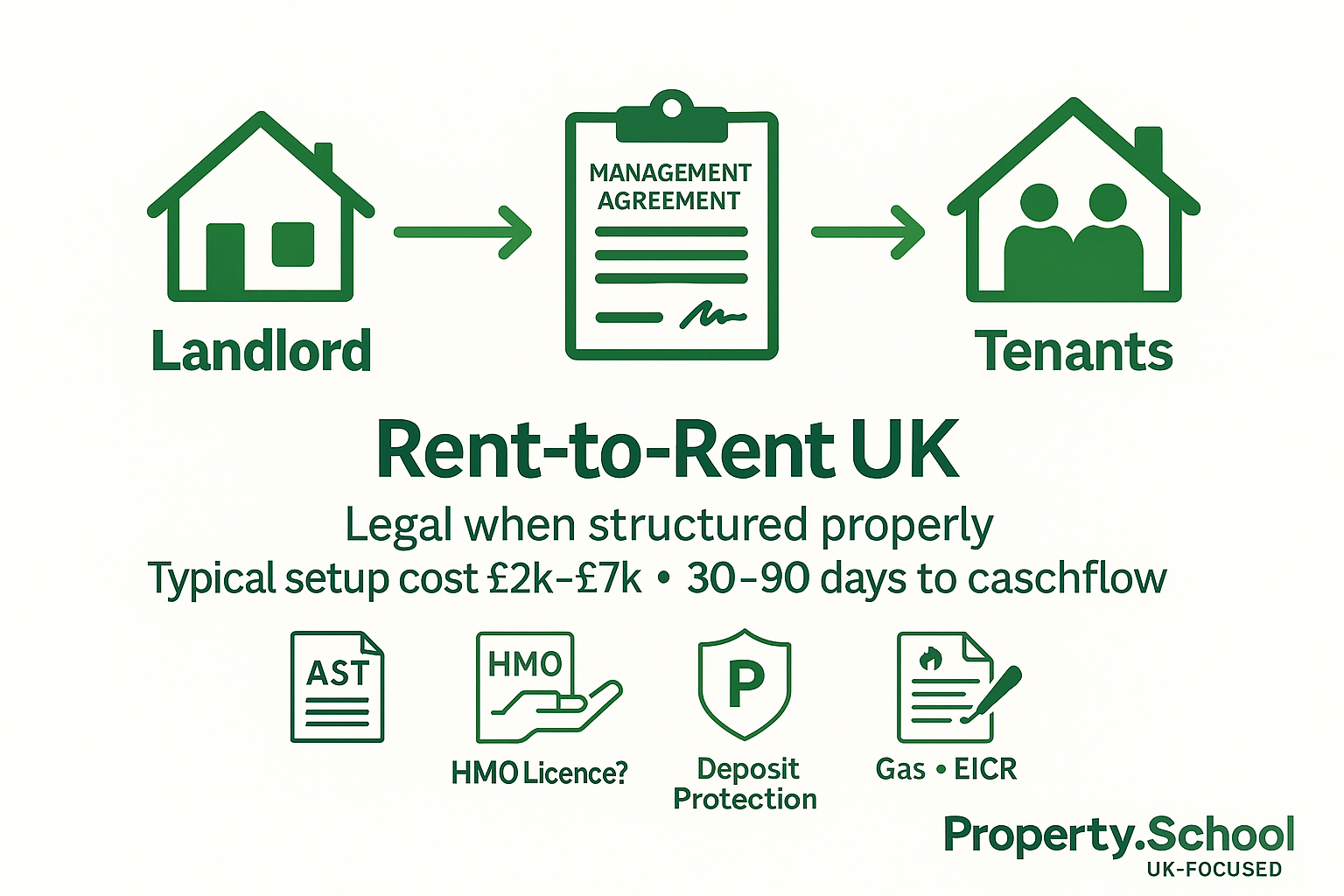

Rent-to-Rent UK: Is It Legal, What Does It Cost, and How Fast Can It Cashflow?

Legality: Legal when structured with the correct agreements; HMOs may require licensing. Always get specialist legal advice.

Typical setup cost: £2k–£7k (deposit, first rent, compliance, light dressing).

Time to cashflow: 30–90 days with the right area and product.

Why it works in 2025: Longer DOM, cautious landlords, and demand for better standards.

Key risks: Voids, licensing/compliance errors, weak contracts.

Mitigate: Compliance checklist, airtight agreements, conservative rent estimates (1.25× cost cover).

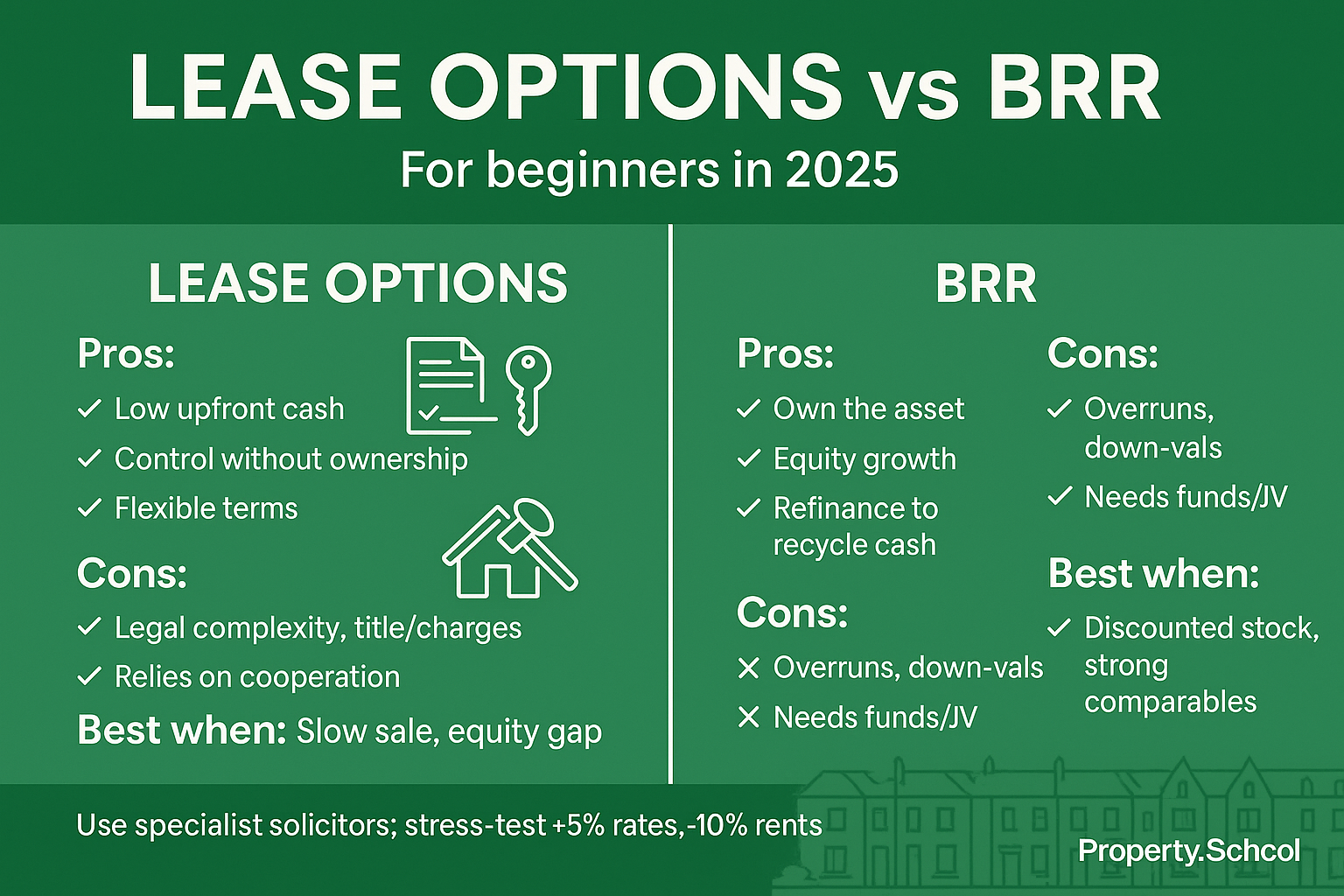

Lease Options vs BRR: Which Is Best for Beginners in 2025?

-

Lease Options

Best for: Sellers stuck on price or equity gap; slow chains.

Pros: Lower cash needed; control without immediate purchase.

Cons: Title/charge complexity; needs specialist solicitor.

Exit: Improve, tenant, refinance or sell per the option terms.

-

BRR (Buy-Refurb-Refinance)

Best for: Buyers with partners/investors funding purchase/refurb.

Pros: Own the asset; equity growth; refinance to recycle cash.

Cons: Down-valuation and refurb overruns can kill returns.

Exit: Refinance at sensible LTV or resale if refi terms change.

Real Case Study: “Emma” — From £0 Experience to £2,000+/mo PASSIVE INCOME

Start point: No prior experience, limited cash.

Strategy: Rent-to-Rent on a 3-bed.

Activity (first 30 days): 20 landlord calls, 6 viewings, 2 offers, 1 accepted.

Result (90 days): ~£600/mo net from Deal #1.

6 months: £2,000+/mo PASSIVE INCOME across multiple units.

Why it worked: A simple script, speed to leads, solid contracts, and ignoring “news paralysis”.

Copy the System That Helped Emma: Get the scripts, calculators, contracts checklist, and weekly reviews inside Property.School.

👉 property.school (cancel anytime)

The Numbers: A Simple BRR Example (So You Can Sanity-Check Deals)

Purchase: £120,000

Refurb: £12,000

SDLT + Legals/Fees: £3,500

Total Investment: £135,500

Post-works GDV: £185,000

Refinance @75% LTV: £138,750

Cash left in (approx): £135,500 – £138,750 = All money back out + £3k in your pocket

Rent: £950/mo

All-in monthly costs: £650/mo

Net cashflow: ~£300/mo

ROCE: Is infinite return (Annual £3,600 ÷ cash left in the deal after refinance = £0) so the return is Infinite.

Reality check: Pulling all your cash isn’t guaranteed.

What matters is buying right, controlling refurb, and having two exits.

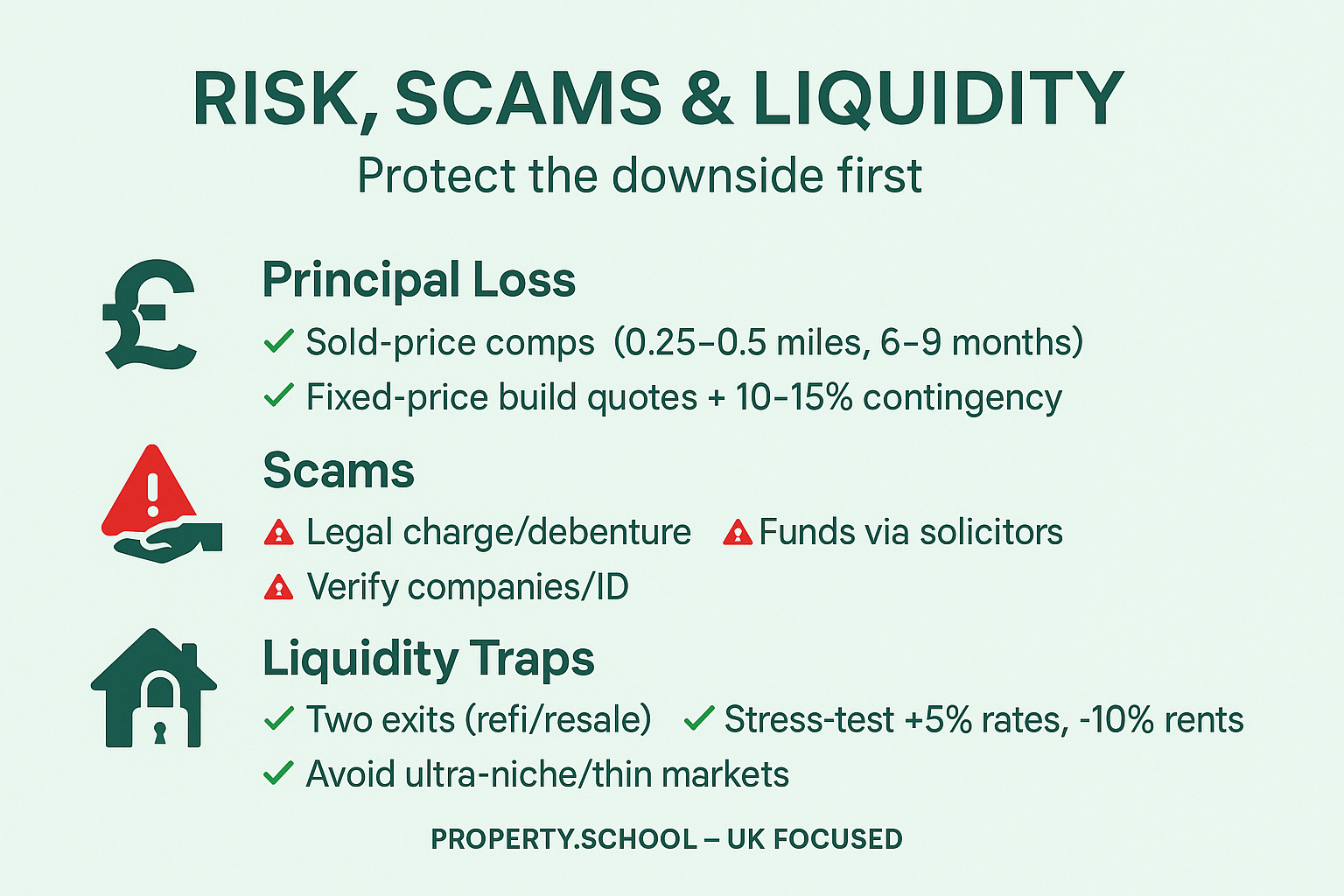

Risk, Scams & Liquidity: Protect the Downside First

1) Principal Loss (overpaying, overruns, down-vals)

Example: Buyer pays near-retail, assumes 3-week refurb → becomes 9 weeks → lender down-values. Equity gone.

Mitigate: Sold-price comps (0.25–0.5 miles; last 6–9 months), defect photos for negotiation, fixed-price build quotes, 10–15% contingency.

2) Scams (unsecured “guaranteed” returns)

Example: 12–18% “loan notes” with no security; funds wired to a private account. Money disappears.

Mitigate: Security first (legal charge/debenture where appropriate), funds via solicitors, verify ownership/IDs/companies, never rely on vague promises.

3) Liquidity Traps (can’t refinance or sell)

Example: Niche asset; lender appetite shifts; exit shuts.

Mitigate: Two exits minimum (refi or resale with live comps), stress-test rates +5% & rents −10%, avoid ultra-niche stock in thin markets.

Tools & Templates That Save Months

Deal Calculator — automates SDLT, cashflow, ROCE.

Viewing Form — standard photos, defects, refurb notes, comps.

Offer Pack — summary page, timelines, PoF/finance in principle.

Compliance Checklist — AML/KYC, licences, fire safety, tenancy docs.

These live inside Property.School, with weekly masterclasses and a community that pressure-tests your deals.

Or you can purchase them as a stand alone starter pack right HERE

FAQs: UK Beginner Property Investing (2025)

Can I really start with little or no money?

Yes. Joint ventures, Rent-to-Rent, Deal Packaging, and Lease Options can produce cashflow and momentum while you build track record for BRR.

Is Rent-to-Rent legal in the UK?

Yes, when done properly with compliant agreements and licensing (e.g., HMOs). Get specialist legal advice.

How much do I need for my first BRR?

Deals vary. Many beginners partner with investors for purchase/refurb while they bring the deal and delivery.

Are Lease Options still viable in 2025?

Yes—especially where sellers face slow sales or equity gaps. Use specialist solicitors and clear triggers.

How do I avoid getting scammed?

Use solicitors, demand security for funds, verify ownership/companies, and avoid vague “guarantees”.

What ROI should a beginner target in 2025?

Aim for stress-tested cashflow and a ROCE that still works at +5% rates and −10% rents.

- Free email delivery

The £5k Property Plan

- Download